Gabelli 31st Annual Aerospace & Defense Symposium

Conference Host: Gabelli Funds, LLC | Portfolio Manager: Tony Bancroft

The Harvard Club, New York City | September 4, 2025

EXECUTIVE SUMMARY

The Gabelli 31st Annual Aerospace & Defense Symposium revealed an industry at an unprecedented inflection point, with executives from 17+ companies providing extraordinary visibility into what multiple presenters characterized as the most significant defense expansion since World War II. The conference confirmed a multi-decade supercycle driven by the convergence of four macro forces: geopolitical realignment, technological disruption, supply chain restructuring, and fundamental changes in military doctrine.

As Elbit Systems' CEO Kobi Kagan starkly warned about the Taiwan crisis:

"The most dangerous place now in the world is the conflict between Taiwan and China and the South China Sea...They say two things just recent announcement. The first one is that Taiwan is ours. And the second one: We will have it up till the beginning of 2027."

PART I: COMPANY PRESENTATIONS WITH EXECUTIVE COMMENTARY

1. DRONESHIELD - Counter-UAS Market Leader

Presenter: Oleg Vornik, CEO (Virtual from Australia) Market Cap: A$2.7 billion

On Global Demand Surge: "We're seeing a significant across the board increase in Europe and Asia Pacific and South America, US, Australia and so on. And that is just driven by military planners saying the time to buy is now, not when you really need it. And clearly every future conflict will have drone and counter drone component to it."

On Ukraine Battlefield Validation: "We have many hundreds of these [DroneGun devices] in Ukraine today and we're getting feedback from Ukrainians that the devices have literally saved their lives. Number of times."

On Business Model Excellence: "We operate roughly 70% gross margin, which is pretty unusual for today. Substantial margins, which is the driver to how highly differentiated we are."

On Market Entry Barriers: "Counter drone is a much more complex business with high barriers to entry in terms of the technology, getting in with the customers and so on."

On Software-as-a-Service Transition: "SaaS, while increasing significantly in percentage terms, is still reasonably low in dollar terms. It's only about 5% of the revenues, but we have a number of strategies to increase to hopefully closer to 30 to forty percent of the overall revenues in the next five years."

On Intelligence from Ukraine: "We have been in Ukraine right from the beginning of the war. We have hundreds of our systems deployed in Ukraine today. We're getting a lot of intelligence from them."

On Manufacturing Expansion: "Today, everything is designed and made in Australia. But there is a significant element of American components...Now we are in the process of setting up US manufacturing as well as European manufacturing."

On Long-term Revenue Vision: "Revenue in the billions is entirely achievable, I think, over the next five to ten years."

2. ELBIT SYSTEMS - Israeli Defense Giant

Presenter: Kobi Kagan, CEO Market Cap: $22.5 billion

On Taiwan Crisis Timeline: "The most dangerous place now in the world is the conflict between Taiwan and China and the South China Sea...Chinese diplomats, what are they saying about Taiwan? And they say two things just recent announcement. The first one is that Taiwan is ours. And the second one: We will have it up till the beginning of 2027."

On Russian Threat to Europe: "Russia, which intends to actually invade Europe. And we are speaking constantly to mostly to the German Ministry of Defense, which currently sees 2029 as the year that Russia will actually invade Europe. And this is against super. And that explained the supercycle that we see in budgets."

On Israeli Market Transformation: "Before the October Seventh War, we had a like a billion dollar new business with a billion dollar revenue...The new business, the Orange Line, went up to two and a quarter billion dollars just last year over 5X demand in Israel."

On European Defense Investment: "Germany decided to invest additional half a trillion euros in defense in the next five years. An additional 500 billion euro in infrastructure defense infrastructure...Each point in Germany is 50 billion euro of additional expenditure."

On Innovation Leadership: "I know that everybody is telling you that they are innovative, but what you see here is the laser pod that will be carried on the narrow body and will allow interception of high of ballistic missiles. This is a super complicated technology, which actually, what we're doing here is coherent beamforming."

On Growth Trajectory: "We expect this year to be around 14% to 15% growth revenue, while last year we were 4% growth in revenue, 55% growth in our EPS the backlog is 12%."

On R&D Investment: "We are investing 7% 6.9% of our revenue in R&D. This is a huge investment compared to our friends here...It's four points more than what is invested in average."

3. RHEINMETALL AG - Europe's Defense Champion

Presenters: Annika Herlitz and Fabian Kirchmann, Investor Relations Market Cap: €87 billion

On Explosive Growth: "Last year, we reached nearly 10 billion in revenues, which was an increase of 36% compared to the previous year. And we had a 15.2% operating margin in the defense business."

On German Vehicle Orders: "Germany alone said over the next twelve months, they are probably looking to order around 40,000 military vehicles from us."

On Italian Opportunity: "Italy is looking to modernize the technical vehicle fleet. They want to order 1,050 infantry fighting vehicles and 300 main battle tanks and support vehicles. That ticket alone for Rheinmetall is €20 billion."

On Manufacturing Revolution: "In our new site in Germany that we just opened up last week in a grand ceremony with Mark Rutte and the German Minister of Defense and Finance, we can operate that plant in three shifts with a total of only 120 people. So 40 people per shift? Once it's fully ramped, we will have an output of around 350,000 shots, leading to an annual sales of 1.5 billion."

On Vertical Integration Advantage: "The high profitability is a result of our vertical integration. We can do the powder, where we are one of the largest producers of powder and other competitors...have to buy any powder from other players."

On NATO Restocking Crisis: "The restocking demand that NATO faces is gigantic. If you look at how many systems Howitzer systems there are, you have two and half thousand in Europe alone. NATO sets itself the target to reach 40 days fighting inventory...at the beginning of the war there were said to be in low single digit days."

On Ukraine Joint Venture: "Mr Zelensky and our CEO were meeting at the Munich Security Conference this February, where the Ukraine said that in a ceasefire or peace scenario...they are looking to restock 1.5 million shots per year, meaning 50 million over ten years."

On 2030 Vision: "By 2030, we think we can reach a level of €40 to €50 billion in sales and a margin of around 20%."

On Market Leadership: "We are the fastest growing defense company in Europe. Our portfolio meets the demand of the battlefield that we see today."

4. CURTISS-WRIGHT CORPORATION

Presenters: Lynn Bamford (CEO), Chris Farkas (CFO) Market Cap: $18 billion

On Historic Heritage (Lynn Bamford): "Curtiss-Wright has been continuously traded on the New York Stock Exchange for 96 years. The Wright in the name comes from Orville Wright, which most people don't realize."

On Engineering Excellence: "We are an engineering centric company. We're just over 9,000 employees, of which about a quarter of them are engineers."

On Mission-Critical Focus: "We are an engineering and manufacturing company that designs niche products for safety critical applications that often operate and must not fail applications."

On Pivot to Growth Strategy: "We launched our pivot to growth strategy just over four years ago...the company had spent the prior decade...really driving financial performance...But the thing that we had not been able to achieve was growth at the top line."

On Defense Growth (Chris Farkas): "This year, it'll reach roughly ten percent of Curtiss Wright's total portfolio, which is 340 million dollars now."

On NATO Opportunity: "If you just take that three and a half percent alone and you turn it into today's dollars, that's a 400 billion dollar opportunity for US defense contractors or defense contractors that are selling to international countries."

On International Defense Markets: "We are going to be growing twenty percent. So we're seeing that order activity accelerate. It's across many of the same products that we sell and have been benefiting from for the past two years."

5. CRANE COMPANY

Presenters: Alex Alkala (COO), Jay Higgs (SVP Aerospace & Electronics) Market Cap: $10.5 billion

On The Crane Machine (Alex Alkala): "That's what I want you to think about when you think about Crane. We developed a unique machine at Crane that drives profitable growth the Crane business system, driving a consistent cadence of innovation and productivity."

On PSI Acquisition: "In June, we announced an agreement to acquire Precision Sensors and Instrumentation from Baker Hughes for 1.1 billion...This transition meets all Crane company strategic and financial criteria, including 10% ROIC by year five."

On Margin Expansion Strategy: "We expect to double the margins in that business. And you know, the profile growth will be supportive of our overall 4% to 6% profile."

On Market Position (Jay Higgs): "Over 90% of our business is sole sourced, 100% is proprietary. We have no build to print business. We own our design IP and manufacture and service our own products."

On Platform Ubiquity: "There's almost no military or aerospace platform that exists today or will exist in the future that doesn't have our product on it."

On Defense Growth Drivers: "We have numerous defense programs now reaching full rate production. These include power systems for numerous AA radar programs, each of which has a lifetime value to us in the nine figures."

6. TEXTRON INC.

Presenter: David, Executive Market Cap: Not disclosed

On FLRAA/MV-75 Program: "The most significant event in our overall company this year has been the reaffirmation of the...FLRAA program but as the MV-75 program. Been working with US Government to actually accelerate that program. That, in essence, we'll be replacing about 4,500 Black Hawk helicopters throughout the world. We think the program in total, at a minimum could be worth between $80-100 billion dollars."

On Current Development Phase: "Right now we're in the development phase. So booking about $300 million of revenue per quarter, which has been growing every quarter."

On Training Systems Growth: "These are ATAX. That's adversarial air. Basically a bad guy for flight training. And they won about a billion dollars in bookings this quarter."

On Business Jet Market: "Since then, we've seen very strong pricing and companies have embarked on a product strategy that's basically one clean sheet and multiple derivatives...which has been very helpful and driven pricing and volume in our company."

7. AERO GROUP HOLDINGS

Presenters: Dr. Wahid Nawabi (Executive Chairman), Dan (SVP Marketing), Dr. Maria Pelav (CFO) Market Cap: $560 million

On Bootstrapped Growth (Dr. Maria Pelav): "I'll again stress we've been growing rapidly and it was all bootstrapped. We have not been getting funding from outside. So 2022: $17 million in revenue, 2023: We had $33 million in revenue and 2024: $86 million. And it's all bootstrapped without outside capital."

On Exceptional Margins: "We had nearly 73.4% gross profit margin in that division. So we allocated the funding and growth there. That division comprised about 86% of our revenue in 2024."

On Revenue Visibility: "Right now, we have visibility for about 200 million in bookings and progress with NATO partners. That includes existing customers that are coming back. That includes new customers that we're talking to."

On NATO Customer Base (Dan): "Currently, you know, over 80% of our business is done with NATO countries, and we sell directly to the NATO countries themselves, much of which our products are put into conflict zones."

On Battlefield Performance: "Our drones have can do 500 plus missions, which means they're not one and done. They have not been taken out of the battlefield...So they perform more than 500 missions they have performed in GPS denied environments."

On Strategic Vision: "Our strategic initiative is that in the next three years to become a company with revenue of half a billion dollar, 20% EBITDA and the market above 1.5 billion dollar."

8. TAT TECHNOLOGIES

Presenter: Igal Zamir, CFO Market Cap: $450 million

On Honeywell APU Opportunity: "Honeywell licensing. This is very important to understand the company and the potential for the future. As I said, we are licensed by Honeywell to repair almost all of their APU...We just penetrated the market of $2.5 billion annual revenue...This market by itself can double the size of the company in the next years."

On Heat Transfer Growth: "The landing gear MRO market is entering now into a four years huge cycles of overhauls, and we're well positioned there with two unique contracts."

On Strategic Vision: "Our strategic initiative is that in the next three years to become a company with revenue of half a billion dollar 20% EBITDA and the market above 1.5 billion dollar."

On Market Position: "We just started being active there, currently generating only several millions. You can count them on one hand...And that's the two point 5 billion dollars market that will support our organic growth in the next couple of years."

9. ASTRONICS CORPORATION

Presenters: Peter Gunderman (CEO), Nancy Hedges (CFO) - Virtual Market Cap: $1.6 billion

On Pandemic Recovery (Peter Gunderman): "We got hit really hard. This chart shows you the revenues on the left side in particular. 773 million before the pandemic hit. We went down to 445. Since then, we've come roaring right back."

On Core Business Segments: "Approximately half of our business is in the inflight entertainment and connectivity space. So passengers riding around in the cabin of commercial airplanes want to plug in their devices."

On Lighting Leadership: "We're actually one of the world's bigger aircraft lighting companies. We do everything from passenger service units like reading lights in 737 to cockpit systems through avionics companies like Collins to exterior lighting systems."

On eVTOL and Drone Opportunity: "There is a world of drones out there on the military side, I think of CCA aircraft. Those are small aircraft. They want advanced remotely controllable electrical power systems. That's what we do."

On Patent Litigation Resolution: "The ruling came in and it was for twelve and a half million. It was right in the middle of the range...So in a sense we won. But we had done this financing. So today our balance sheet is by hook or by crook, you know, much more comfortable."

10. NEW HORIZON AIRCRAFT

Presenter: Brandon Robinson, CEO Market Cap: $65 million

On Revolutionary Performance: "Think of a helicopter that is literally twice as fast. Saves about 75% of unit cost. Or sorry, of cost per unit mile. So every mile that it goes. And 75% cheaper than a helicopter. It is a lot safer and a lot more comfortable to ride in and a lot quieter."

On Development Timeline: "In eighteen to twenty four months, we will have a full scale aircraft sitting in our hangar, ready to do flight testing. Now if anyone's paying attention to the market, other companies that are doing that at that scale have, you know, let's say anywhere from ten to 200 times our market cap."

On Technical Achievement: "The transition from vertical flight to forward flight has historically been a very technically challenging thing for almost every company in this space. Joey, Archer, the multibillion dollar market caps...Ours was the most boring transition that you've ever seen in the history of transition to forward flight and in aerospace. Boring is awesome, right? Boring is safe, boring is predictable."

On Market Demand: "If the airplane works the way we say it's going to work or even close, and we can save anywhere from 60 to 75% per unit mile and basically build a faster, cheaper, safer, quieter helicopter...We're not so worried about demand."

On Defense Applications: "I flew jets in the Air Force for about 20 years...I would have loved to have an airplane like this in the military...Smaller than a V-22 Osprey. More agile, faster, and of course, you know, it's a little bit cheaper to own and operate."

11. GRAHAM CORPORATION

Presenters: Matt Malone (CEO), Chris Thome (CFO) Market Cap: $530 million

On Company Heritage (Matt Malone): "Graham Corporation was founded in 1936. So it's been a ninety year business. And over those 90 years, it's been primarily in the energy and process side...Over those ninety years, we've developed almost a billion dollar installed base around the world."

On Defense Diversification: "Today, we've diversified the business to be 60% defense. And with that diversification, it allows for a really stable platform business."

On Backlog Visibility: "We have 500 million ish dollars of backlog, which allows us to make really long standing investments in the business."

On Space Market Growth: "Launch capability is really proliferating. So we're seeing a lot of launch capability go to market. And we have critical rotating machines that provide the fuel to the rockets that allow for cryogenic recirculation."

On SMR Opportunity: "We're talking about the main helium circulator for a small modular nuclear reactor or the supercritical CO2 machine that converts the mechanical to electrical power. These are systems that are not insignificant scope."

12. REDWIRE CORPORATION

Presenter: Jonathan Ball, CFO Market Cap: $1.3 billion

On Founding Vision: "Red Wire was founded five years ago by AE Industrial Partners, probably the leading aerospace and defense investor...They're the ones who saw that there was no mid market kind of TransDigm or HEICO for space."

On Market Position: "We're at the nexus of commercial space and defense tech, which includes national security, international defense and security and obviously civil space, which includes NASA and ESA."

On Edge Autonomy Acquisition: "The edge acquisition was approximately $925 million. It was announced in January, closed at the end of June. This is transformative...It allows us to be broader than just a space tech company. It's space and defense tech."

On Launch Cost Revolution: "Launch costs have come down from $2 million a kilogram, you know, about 30-40 years ago to...SPACEX wants to bring it down to $200 a kg, which is very similar to a 747."

On Revenue Scale: "At midpoint this year, we're saying we're going to get about five hundred million dollars in revenue."

On Growth Philosophy: "If you can grow a defense and aerospace company at 20%, do that profitably. Have some free cash flow. That's a super valuable property. There are companies today...that grow at 10% are free cash flow neutral to slightly negative. They're trading at 5-9 years."

13. BRIDGER AEROSPACE

Presenters: Sam Davis (CEO), Eric Gerratt (CFO) - Virtual Market Cap: $113 million

On Company Origins (Sam Davis): "Bridger was founded in 2014 by a former Navy SEAL who saw the opportunity to bring his passion for technology and aviation together and happened to find the perfect home in Montana in the heart of wildfire country."

On Fleet Positioning: "We have six of the ten [Super Scoopers] located in the US so a very unique position in the market of having, we believe, the most effective firefighting tool out there."

On Operational Capability: "The Super Scoopers with a 1,400 gallon tank can continuously scoop and drop water from a nearby water source on one fuel cycle. So they can drop hundreds of thousands of gallons of water in a day."

On Geographic Coverage: "We're operating all over the country year round now. Wildfires are year round and a threat. From this year we've been in Tennessee to the Palisades Fire in LA. And from Texas all the way to Alaska."

14. STANDARD AERO

Presenters: Dan Satterfield (CFO), Alex Trump (CSO) Market Cap: $9 billion

On Platform Diversification (Dan Satterfield): "We provide services across 40 platforms today. That makes us quite unique. We are not only focused on one platform as some of our competitors are."

On Recession Resilience: "During Covid where total aftermarket spend in the industry declined by 41%, Standard Aero's revenues only declined 16%. And that's due to the balanced portfolio that we have across many platforms."

On LEAP Engine Position: "Our new platform wins are most significantly highlighted by the LEAP platform, where we are one of only six CFMI license holders. This is the highest level of license offered by CFM on this program. And the LEAP program is expected to be the largest engine program in history."

On Component Repair Margins: "We love this segment today. About 28.7% margins as of the first half of 2025...We believe if this business were to stand alone by itself, it would be one of the largest component repair businesses in the world."

On Growth Trajectory: "Through 2024 has grown adjusted EBITDA of about 22%. And we expect this ratio to continue throughout five important key levers."

On Test Cell Infrastructure: "We have a strategically located global footprint with 50 facilities globally and importantly, 55 global test cells. One of the highest barriers of entry into the aerospace MRO market."

15. HEICO CORPORATION

Presenter: Victor Mendelson, Co-President/CEO Electronics Technology Group Market Cap: $40 billion

On Business Model: "HEICO is mostly known for its commercial aircraft aftermarket business, in particular what people refer to as PMA parts...We are in that business like generic drugs or the pharmaceutical industry."

On Company History: "We took over the company actually in 1990...It's a small business that had about 25 million dollar market cap."

On Pricing Strategy: "We sell our parts typically about 30% less than the OEMs."

On OEM Pricing Behavior: "If there's only one source of parts, the original equipment manufacturer, what does a logical, rational person do? They raise prices every year and averages 6% to 13% a year, regardless of economic best times or the worst times."

On Acquisition Success: "WenCore has been a huge home run."

On Growth Trajectory: "We've hit probably we've had a lot of new opportunities because we've gotten to a certain size. We're getting more opportunities. I think we're getting more respect in the market."

16. DUCOMMUN INCORPORATED

Presenter: Steve Oswald, CEO Market Cap: $1.4 billion

On Company Heritage: "We're the oldest continuous company in California, so we've been operating and the doors open since 1849. I started as a very humble general store...Charles Ducommun came to New York in 1843 as an immigrant...took him nine months to walk across the country."

On Missile Production Surge: "We get someone from Huntsville, Alabama...pretty much what he told us was that, you know, we've used all these missiles or a lot of them to defend Israel...basically they told us you need to quote twenty five a month from two...going from two to fifteen is like a big deal, right?"

On Composite Technology Revolution: "Not only can we replace titanium with this technology, we can make a carbon part that is near net shape. Today, most of these parts are made as a block and it's machined away. It's very expensive to machine it away."

On Hypersonic Opportunity: "I heard earlier that we were talking about the Golden Dome...There is not an industrial base to support the hypersonic industry in the US and we have a solution there as well, and we're capitalizing for it."

On Strategic Focus: "The focus of the company going forward is going to absolutely be around the composites."

17. ATEX AEROSPACE (UAE)

Presenter: Dalip Kumar, Regional Representative Market Cap: Private

On Middle East Market Size: "Saudi Arabia itself is spending $80 billion only on defense. And the UAE and Saudi Arabia are the two major players...hundred billion plus year on year."

On Fleet Scale: "There are 400 plus...Saudi Arabia has 450 plus defense aircraft and helicopters. So you can imagine the such a huge fleet."

On Regional Growth Thesis: "I find the difference is...I see the growth is going to come up from the Gulf region...the last five to ten years, what I see is a huge improvement in the budget, improvement in the fleet and we are getting the world most renowned aircraft."

On Government Support: "Government is saying we are giving you platform there is a huge capital there is certification enough opportunities that come established there supporting...I find the as I said, there is a market see 10 billion now and believe in another three four years it can go to 15 billion dollars."

On Strategic Position: "The GCC is the we are very centrally located the East and West. We connect the people...when you have a hub in Dubai, we solve in within six hours. So definitely that gives us an advantages."

PART II: THEMATIC ANALYSIS

THE GEOPOLITICAL REALIGNMENT

The symposium revealed unprecedented clarity on three primary threat vectors:

1. Taiwan Timeline (2027)

- Elbit's Kagan: Direct Chinese statements claiming Taiwan by 2027

- Multiple companies repositioning supply chains

- Accelerated U.S. Pacific deterrence investments

2. European Defense Crisis (2029)

- German MoD assessment: Russia invasion threat by 2029

- NATO spending trajectory: 2% → 3.5% → 5% GDP

- €1 trillion European defense spend by 2030

3. Middle East Expansion

- 5X demand increase in Israel post-October 7

- Saudi Arabia: $80 billion annual defense budget

- UAE emerging as global defense hub

THE SUPPLY CHAIN REVOLUTION

Ammunition Crisis:

- NATO: 40-day inventory target vs. single-digit reality

- European capacity: 2 million shells/year vs. 20 million needed

- 10-year restocking timeline at current production rates

Manufacturing Transformation:

- Rheinmetall: 120 workers producing 350,000 shells (vs. 1,800 for 300,000 previously)

- Automation reducing labor by 93%

- Vertical integration driving 30%+ margins

THE TECHNOLOGY DISRUPTION

Counter-Drone Revolution:

- DroneShield: 70% gross margins

- Ukraine battlefield validation changing doctrine

- Civilian market "yet to come"

Composite Materials:

- Ducommun: Replacing titanium at scale

- Near-net-shape manufacturing

- Hypersonic applications emerging

eVTOL/Advanced Air Mobility:

- New Horizon: 75% cost reduction vs. helicopters

- 18-24 month path to full-scale aircraft

- Dual-use military/civilian applications

PART III: FINANCIAL IMPLICATIONS

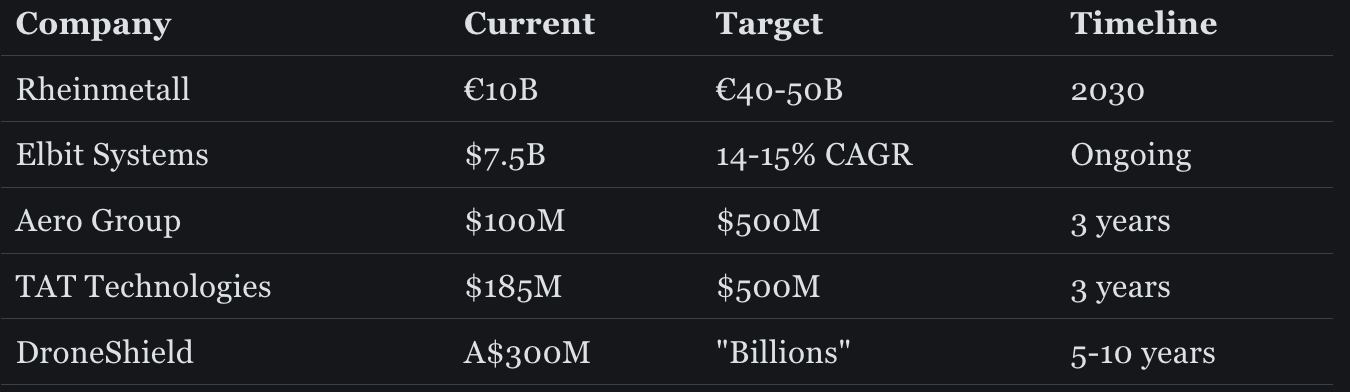

Revenue Growth Trajectories

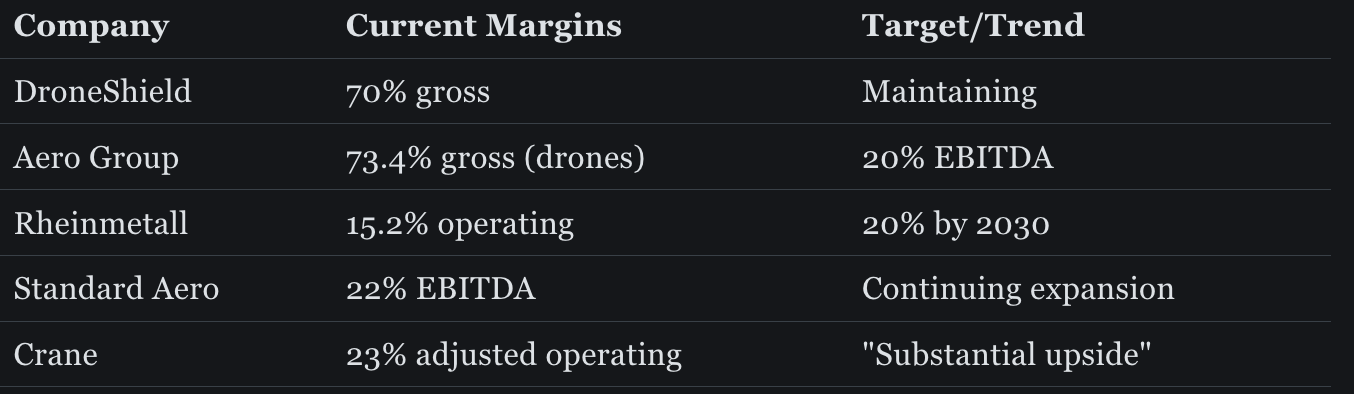

Margin Expansion Stories

Capital Deployment Priorities

M&A Activity:

- Rheinmetall: Iveco logistics, naval expansion

- Crane: $1.1B Baker Hughes PSI acquisition

- Redwire: $925M Edge Autonomy acquisition

- Multiple companies: Active pipelines, disciplined approach

Organic Investment:

- Rheinmetall: 9% of sales CAPEX

- Elbit: 6.9% R&D spending

- Manufacturing capacity: U.S. and European expansion

Shareholder Returns:

- Curtiss-Wright: $750M buybacks over 3 years

- Elbit: Dividend increased twice in 2025

- HEICO: Consistent capital returns

PART IV: INVESTMENT CONCLUSIONS

The Supercycle Thesis Confirmed

The Gabelli symposium confirmed that the defense industry has entered its most significant expansion since World War II. Multiple data points support a multi-decade growth trajectory:

- Demand Visibility: Order backlogs at record levels across all companies

- Margin Expansion: Technology differentiation and automation are driving unprecedented profitability

- Geographic Diversification: Growth beyond traditional markets into Middle East, Asia-Pacific

- Technological Disruption: New categories (counter-drone, hypersonics, eVTOL) creating additional TAM

Key Investment Themes

1. Pure-Play Defense Winners

- Rheinmetall: "Fastest growing defense company in Europe"

- Elbit Systems: 5X domestic demand, European expansion

- DroneShield: 70% gross margins in nascent market

2. Technology Disruptors

- Aero Group: 160% revenue growth, 73% gross margins

- New Horizon: Revolutionary cost reduction in vertical lift

- Ducommun: Composite materials replacing legacy solutions

3. Platform Consolidators

- HEICO: PMA market leader with acquisition engine

- Standard Aero: 40 platforms, recession-resilient model

- Crane: "The Machine" driving consistent execution

4. Transformation Stories

- TAT Technologies: APU market entry doubles revenue potential

- Graham Corporation: 60% defense diversification

- Redwire: Space-to-defense pivot via Edge Autonomy

Risk Considerations

- Execution Risk: Unprecedented ramp rates are challenging supply chains

- At a time when supply chains are most challenged, a war in the Pacific would be catastrophic to supply chains as-is.are

- Political Risk: Defense budgets are subject to political cycles

- This conference showed that Big Business and Wall Street think that the Defense budget process is like any other year. But it's not. This administration is not subject to the past methods and status quo. No matter what Congress passes, there is no guarantee that the executive will spend it as appropriated. And with reconciliation and the total sideline of Congress, this administration would make due with sequestration or a full shutdown. If they must.

- Technology Risk: Rapid innovation potentially disrupting incumbents

- Incumbents maintain current training and cement the "man, train, equip" mission, which is the penultimate step before wartime deployments. If new tech forces legacy sunsets before there is a train and equip, it means direct ship to war theatre, where training is ad hoc and not structured. This will reduce efficacy and possibly stymie overall use of unfamiliar new systems, which is the penultimate step before wartime deployments.

- Valuation Risk: Multiple expansions are already significant

- There is a question of how many new entrants can go public and if the public market can handle the private valuations, especially if there's a market downturn and the real economy, not the financial markets, crater and the US stocks and glpobal stocks are suprresed. The firms that will be immune, like Rheinmetall, have some resistance because of foreign stock exchange and the worse the US economy, the more likely accelerated Russian aggression on NATO borderlands.

Close-out

As Rheinmetall's executives concluded:

"We are expecting that defense spending is going to stay continuously on a much higher level than we've seen before."

The combination of geopolitical realignment, technological disruption, and fundamental military doctrine changes suggests this is not a cyclical upturn but a structural shift in global defense priorities.

The Gabelli 31st Annual Aerospace & Defense Symposium provided visibility into an industry transformation that executive after executive characterized as generational. With NATO spending moving from 2% to potentially 5% of GDP, ammunition stockpiles requiring decade-long replenishment, and new threat vectors emerging across multiple domains, the defense sector appears positioned for sustained outperformance.

Source: Gabelli 31st Annual Aerospace & Defense Symposium, The Harvard Club, New York City, September 4, 2025

Conference Host: Gabelli Funds, LLC, a registered investment adviser

Contact: Tony Bancroft, Portfolio Manager, (914) 921-5083

Disclosure: This report contains forward-looking statements subject to risks and uncertainties. Past performance does not guarantee future results. This is not investment advice.